What to Expect at Closing

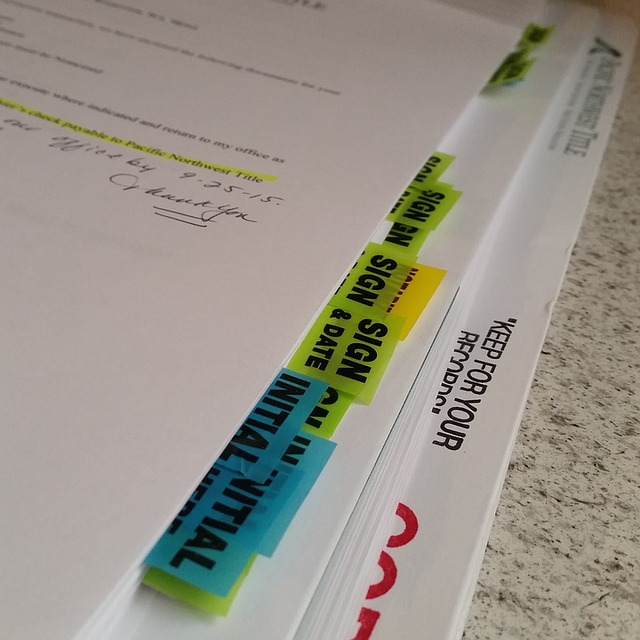

At your Closing, the attorney will review various documents with you. Some of those documents may be:

- Settlement Statement and/or Closing Disclosure (sometimes called a HUD, an ALTA, or a “CD”) – this document shows the details of the financial side of the transaction, including which parties are paying for which items.

Buyer/Borrower-Specific Documents:

- Promissory Note – this is the document that explains the agreement between the Borrower/Buyer and their Lender regarding the loan that is being received.

- Security Deed – this is the “Mortgage” that will be recorded at the Courthouse, giving the lender the ability to foreclose on the property if the Borrower/Buyer stops making payments.

- IRS Forms W-9 and 4506/8821 – this allows the Lender to receive confirmation from the IRS or the Social Security Administration of information provided to them previously by the Borrower/Buyer.

Seller-Specific Documents:

- Warranty Deed – this is the document that transfers the property from the Seller to the Buyer; it will be recorded at the Courthouse after the closing and then returned to the Buyer.

- Seller’s Affidavit – this document verifies that there are no judgments, liens, bankruptcies, or divorces currently pending against the Seller; it also verifies that the Seller does not owe any additional amounts on the property other than any amounts that are being paid off as part of the closing.

- IRS Forms – the Seller will be required to complete a form (or forms) regarding the proceeds of the sale. Our office is required by law to report that the Seller received these proceeds, and these forms must be completed for us to accurately do so. Proceeds will not be disbursed until these forms are signed and received by our office.